How To Calculate Valuation Of A Company With Example

Introduction

Understanding how to calculate the valuation of a company is crucial for investors, analysts, and business professionals alike. Valuation serves as a fundamental metric in assessing a company’s worth, aiding in strategic decision-making, investments, and market competitiveness. In this guide, we will delve into various methods employed to determine a company’s value, exploring market capitalization, earnings multiples such as P/E ratio and EBITDA multiple, discounted cash flow (DCF) analysis, and comparable company analysis (CCA). Through practical examples, we will demystify each method, highlighting their strengths, limitations, and practical applications.

As we navigate through these techniques, it becomes evident that a nuanced understanding of industry trends, financial performance, and growth prospects is essential for accurate and insightful valuations. Join us on this exploration of company valuation, equipping yourself with the tools to navigate the intricate world of financial analysis.

A Comprehensive Guide on How to Calculate Company Valuation with Practical Examples

I. Market Capitalization:

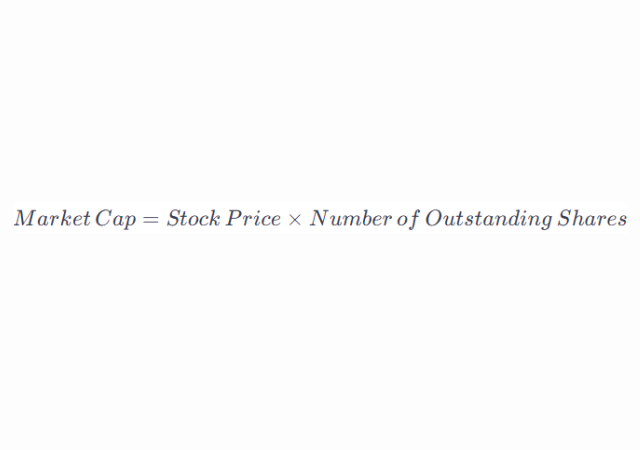

Market capitalization, often referred to as market cap, is a straightforward method for estimating a company’s value based on its stock price and the number of outstanding shares. The formula is simple:

For example, let’s consider a fictional company, ABC Corporation, with a stock price of $50 and one million outstanding shares. The market cap would be $50 million (50 * 1,000,000).

II. Earnings Multiples:

A. Price-to-Earnings (P/E) Ratio:

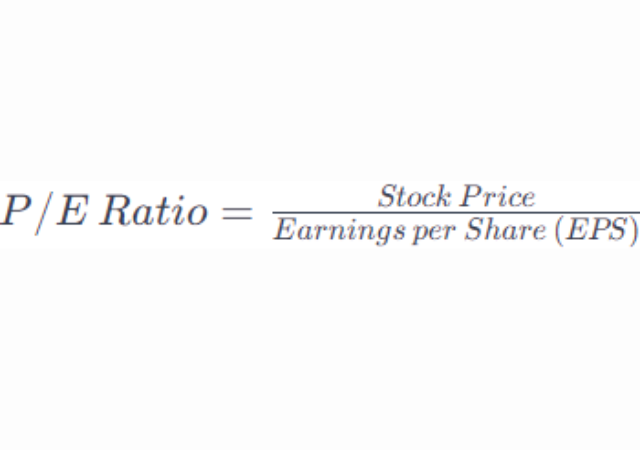

The P/E ratio is a widely used valuation metric that compares a company’s stock price to its earnings per share (EPS). The formula is:

Suppose ABC Corporation has an EPS of $3.50 and a stock price of $50. The P/E ratio would be ![]() resulting in a P/E ratio of approximately 14.29.

resulting in a P/E ratio of approximately 14.29.

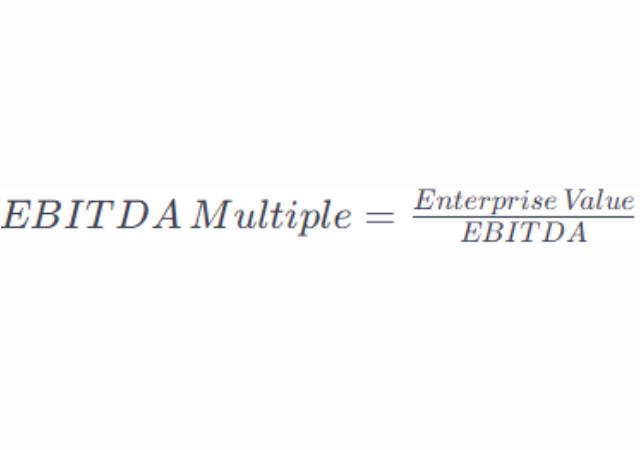

B. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) Multiple:

The EBITDA multiple assesses a company’s value relative to its EBITDA, providing a measure of operating performance. The formula is:

If ABC Corporation has an enterprise value of $80 million and an EBITDA of $20 million, the EBITDA multiple would be ![]()

III. Discounted Cash Flow (DCF) Analysis:

DCF analysis estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to present value. The process involves three key steps:

A. Forecasting Free Cash Flows:

This step requires estimating the company’s expected free cash flows over a specific period, often five to ten years.

B. Determining the Discount Rate (Weighted Average Cost of Capital – WACC):

The WACC reflects the company’s cost of capital and is used to discount future cash flows. It is calculated by weighting the cost of equity and the cost of debt based on their respective proportions in the capital structure.

C. Calculating Terminal Value:

Terminal value represents the present value of all future cash flows beyond the explicit forecast period. Two common methods for calculating terminal value are the perpetuity growth model and the exit multiple method.

For instance, if ABC Corporation is projected to generate free cash flows of $10 million annually for the next ten years, and the WACC is 10%, the DCF valuation would involve discounting these cash flows to their present value using the WACC.

IV. Comparable Company Analysis (CCA):

CCA involves comparing a company’s valuation multiples to those of similar companies in the industry. The process includes:

A. Identifying Comparable Companies:

Selecting companies with similar business models, size, and market presence for comparison.

B. Calculating Valuation Multiples:

Determining relevant multiples such as P/E ratio, EV/EBITDA, or Price/Sales for the comparable companies.

For example, if ABC Corporation’s P/E ratio is 14.29, and comparable companies in the industry have an average P/E ratio of 12, this information can be used to assess whether ABC is overvalued or undervalued relative to its peers.

V. Factors Affecting Company Valuation:

A. Industry Trends:

Understanding industry dynamics and trends is crucial for accurate valuation. Industries experiencing growth may command higher valuations, while those facing challenges may see lower valuations.

B. Financial Performance:

Consistent revenue growth, healthy profit margins, and efficient capital management positively influence a company’s valuation.

C. Growth Prospects:

Companies with strong growth prospects are often valued more highly. Evaluating a company’s potential for expansion and market share gains is essential.

D. Risk Factors:

Assessing risks, including market volatility, economic uncertainties, and industry-specific challenges, helps investors make informed decisions.

VI. Limitations and Challenges:

A. Market Volatility:

Valuations can be influenced by market sentiment and external factors, leading to fluctuations in stock prices and potential mispricing.

B. Uncertainty in Future Cash Flows:

Forecasting future cash flows involves inherent uncertainty, and small changes in assumptions can significantly impact valuations.

C. Subjectivity in Choosing Discount Rates:

Selecting the appropriate discount rate for DCF analysis involves subjectivity, and variations in this rate can alter valuation outcomes.

Conclusion (How To Calculate Valuation Of A Company With Example)

In conclusion, this comprehensive guide has elucidated various valuation methodologies, from the straightforward market capitalization to sophisticated discounted cash flow analysis and comparable company assessments. Through practical examples, we’ve unraveled the intricacies of earnings multiples, shedding light on their applications and limitations. Understanding factors influencing company valuation, such as industry trends, financial performance, growth prospects, and risk factors, empowers stakeholders to make well-informed decisions. Despite the challenges and subjectivity inherent in valuation, this guide equips individuals with the knowledge needed to navigate the dynamic landscape of company valuation and enhance strategic decision-making.

My name is Rohit Vagh and I’m a content writer specializing in fashion and lifestyle. I have three years of experience in this field and have written various articles. My writing style is creative and engaging, and I strive to create content that resonates with my readers. I have a deep passion for fashion and am constantly researching the latest trends and styles to make sure my readers are up to date. I’m excited to continue my career in blogging, and I’m always looking for new opportunities in the fashion and lifestyle space.