How to Calculate and Interpret Equity and Debt Ratio for Your Business

Introduction

Understanding Equity and Debt

A. Explanation of Equity

Equity represents ownership in a business and is a fundamental component of a company’s capital structure. It can take various forms, including common equity and preferred equity. Common equity is derived from the sale of common stock, while preferred equity represents a higher claim on the company’s assets and earnings. Sources of equity include shareholders’ equity, reflecting the investment made by shareholders, and retained earnings, the accumulated profits kept within the business.

B. Explanation of Debt

Debt, on the other hand, involves borrowed capital that must be repaid over time. It comes in different forms, such as short-term and long-term debt. Short-term debt typically includes obligations due within one year, while long-term debt extends beyond that timeframe. Sources of debt include loans and bonds, with interest payments constituting the cost of borrowing.

Calculating Equity and Debt Ratio

A. Formula for Equity Ratio

The equity ratio is a key metric for assessing the proportion of a company’s assets financed by equity. The formula for the equity ratio is:

A higher equity ratio indicates a greater proportion of assets financed by equity, reflecting a lower financial risk. Interpreting this ratio involves understanding the balance between ownership and external financing.

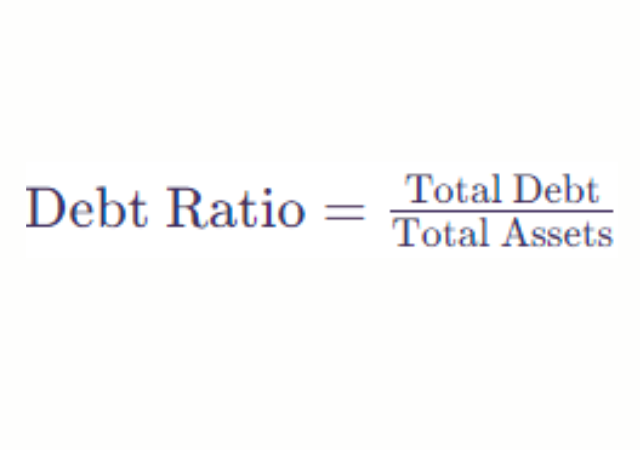

B. Formula for Debt Ratio

The debt ratio measures the proportion of a company’s assets financed by debt. The formula for the debt ratio is:

A higher debt ratio signifies a greater reliance on borrowed funds, which can enhance returns but also escalates financial risk. Analyzing the debt ratio provides insights into the business’s leverage and its ability to meet debt obligations.

C. Combined Ratio: Equity + Debt = 1

It’s crucial to recognize that the equity and debt ratios are complementary and add up to 1. This implies that a company’s assets are financed by a combination of equity and debt. Understanding the combined ratio is essential for a holistic view of the capital structure and risk profile.

Importance of Equity and Debt Ratio Analysis

A. Financial Health Assessment

Equity and debt ratios are instrumental in evaluating a company’s financial health. A higher equity ratio often signifies stability and a lower risk of financial distress, while a higher debt ratio may indicate a more aggressive approach with potential for higher returns but increased financial vulnerability. Comparing these ratios against industry benchmarks provides context for performance evaluation.

B. Decision-Making for Stakeholders

- Investors: Investors analyze equity and debt ratios to assess the risk and return profile of a business. A balanced approach with an optimal mix of equity and debt may be appealing, as it signifies a strategic use of capital.

- Creditors: Lenders scrutinize these ratios to gauge the borrower’s ability to meet debt obligations. A lower debt ratio may instill confidence in creditors regarding the business’s capacity to repay loans.

- Management: Business leaders utilize equity and debt ratios in strategic planning. They help in determining the optimal capital structure, influencing decisions on whether to raise additional capital or retire existing debt.

Case Study: Calculating and Interpreting Equity and Debt Ratio

A. Real-life Example of a Business

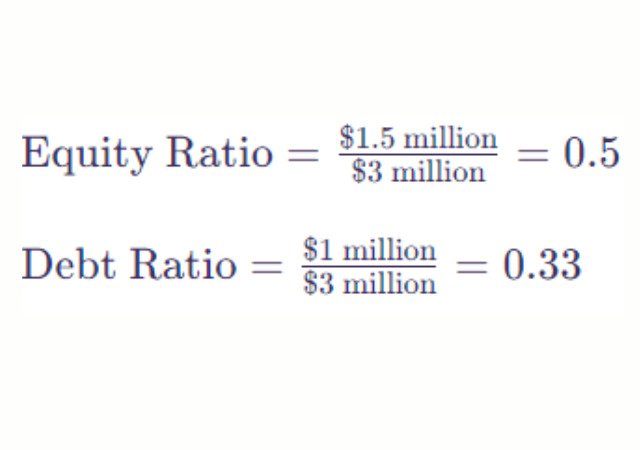

Consider a hypothetical business with shareholders’ equity of $1.5 million, total debt of $1 million, and total assets of $3 million. Applying the formulas:

The combined ratio is 0.83 (Equity Ratio + Debt Ratio). This indicates that 83% of the assets are financed through a combination of equity and debt.

B. Analyzing the Results

The equity ratio of 0.5 suggests that half of the assets are funded by equity, providing a moderate level of financial stability. The debt ratio of 0.33 indicates a relatively low reliance on debt, which can be perceived positively. However, interpretation should consider industry benchmarks and business objectives.

Strategies for Managing Equity and Debt Ratios

A. Adjusting Capital Structure

- Reducing Debt: Businesses can mitigate risk by retiring existing debt or opting for less debt in their capital structure. This reduces interest expenses and enhances financial stability.

- Raising Equity: Increasing equity through the issuance of common stock or retaining earnings can strengthen the equity position, lowering financial risk.

B. Financial Planning and Forecasting

- Anticipating Future Capital Needs: Proactive financial planning involves anticipating the need for additional capital and strategically choosing between equity and debt financing.

- Mitigating Risks: Forecasting potential economic downturns and assessing their impact on the business allows for risk mitigation strategies, influencing the choice of capital structure.

Common Pitfalls in Equity and Debt Ratio Analysis

A. Misinterpretation of Ratios

Misinterpreting equity and debt ratios can lead to flawed decisions. For instance, a high debt ratio may not always signify financial distress if the business generates sufficient cash flows to cover debt obligations.

B. Ignoring Industry Dynamics

Industry norms and dynamics significantly influence the optimal equity and debt ratios. Failing to consider these factors can result in an inaccurate assessment of a company’s financial position.

C. Failing to Consider Market Conditions

Economic conditions, interest rates, and market trends impact the cost of debt and equity. Ignoring these external factors can lead to suboptimal financial decisions.

Conclusion (How to Calculate and Interpret Equity and Debt Ratio for Your Business)

My name is Rohit Vagh and I’m a content writer specializing in fashion and lifestyle. I have three years of experience in this field and have written various articles. My writing style is creative and engaging, and I strive to create content that resonates with my readers. I have a deep passion for fashion and am constantly researching the latest trends and styles to make sure my readers are up to date. I’m excited to continue my career in blogging, and I’m always looking for new opportunities in the fashion and lifestyle space.