How I Plan to Turn 22 into 1 Crore by 25 with Intraday Trading – Here’s How Much You Need to Invest!

Introduction

Turning 22 is a milestone, a crossroads of youth and impending adulthood. As I reached this age, I decided to set an ambitious goal: to earn 1 crore INR by the time I turn 25 through intraday trading. It’s a daring endeavor, given the volatile nature of the stock market, but I believe that with the right approach, it’s achievable. Let me take you through my journey, the strategies I plan to employ, and most importantly, the minimum amount you need to invest to reach this goal.

How I Plan to Turn 22 into 1 Crore by 25 with Intraday Trading – Here’s How Much You Need to Invest!

Why Intraday Trading?

Intraday trading involves buying and selling stocks within the same trading day, capitalizing on small price movements. Unlike long-term investments, intraday trading offers the potential for high returns in a short period. However, it also comes with significant risks. The allure for me lies in the challenge and the potential to accelerate wealth accumulation if done correctly.

Setting the Goal: 1 Crore in 3 Years

To put things in perspective, 1 crore is equivalent to 10 million INR. Achieving this in three years through intraday trading requires a strategic plan, disciplined execution, and a bit of luck. Here’s how I broke down the goal:

- Annual Target: 3.33 million INR per year.

- Monthly Target: Approximately 278,000 INR per month.

Understanding the Investment Requirement

The first step in this journey is determining how much I need to invest initially. Let’s break down the calculations:

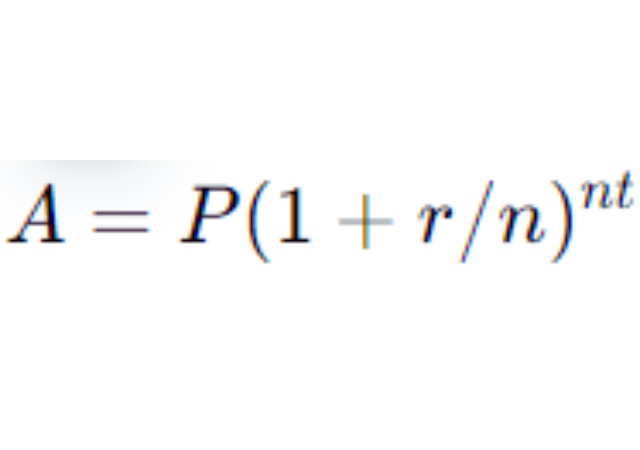

1. Compound Interest Formula: To find out the initial investment required to achieve 1 crore in three years with a specific return rate, we use the compound interest formula:

where:

-

- = the future value (1 crore)

- = the principal amount (initial investment)

- = annual return rate

- = number of times the interest is compounded per year (assuming monthly compounding, )

- = number of years (3 years)

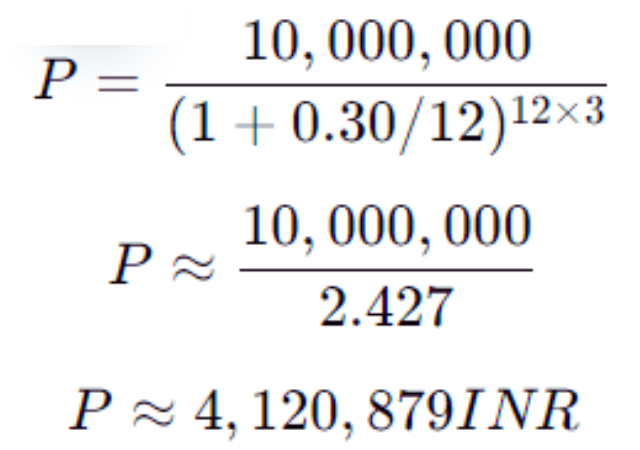

2. Assuming a 30% Annual Return: Achieving a 30% annual return in intraday trading is highly optimistic but not impossible with the right strategies and risk management. Plugging these values into the formula, we get:

This means I would need to start with approximately 4.12 million INR to reach my goal, assuming a 30% annual return compounded monthly.

Crafting the Trading Strategy

Achieving high returns requires a well-thought-out trading strategy. Here are the key components of my plan:

- Education and Research: Before diving into intraday trading, I invested time in learning the fundamentals of the stock market, technical analysis, and trading strategies. I read books, took online courses, and followed market experts.

- Developing a Trading Plan: A solid trading plan is essential. My plan includes:

- Stock Selection: Choosing highly liquid stocks with significant daily price movements.

- Entry and Exit Points: Using technical indicators like moving averages, RSI, and MACD to determine optimal entry and exit points.

- Risk Management: Setting stop-loss orders to limit potential losses and not risking more than 1-2% of my capital on a single trade.

- Starting Small: Instead of investing the entire amount upfront, I plan to start with a smaller amount, say 500,000 INR, to test my strategies and gain confidence. As I become more consistent and profitable, I will scale up my investment.

- Discipline and Patience: Emotional control is crucial in trading. I aim to stick to my plan, avoid impulsive decisions, and be patient, understanding that not every trade will be profitable.

Managing Risks

Intraday trading is inherently risky, and the chances of losing money are high. To mitigate these risks, I follow these principles:

- Diversification: Avoid putting all my money into a single stock or sector. Diversifying helps spread the risk.

- Continuous Learning: The market is dynamic, and staying updated with the latest trends and news is vital.

- Using Technology: Leveraging trading software and tools for analysis, alerts, and automated trading to improve efficiency and accuracy.

Monitoring Progress and Adjusting Strategies

Achieving 1 crore in three years requires continuous monitoring and adjusting of strategies based on market conditions. I plan to:

- Review Monthly Performance: Assess my trading performance monthly to identify strengths and areas for improvement.

- Adjust Risk Levels: Depending on my progress, I may need to adjust my risk tolerance and investment amounts.

- Seek Mentorship: Engaging with experienced traders for insights and guidance to refine my strategies.

The Emotional Journey

Setting such a lofty goal at 22 is as much an emotional journey as a financial one. The excitement of potential high returns is often tempered by the fear of significant losses. Here’s how I manage the emotional rollercoaster:

- Mindfulness and Stress Management: Practicing mindfulness and stress management techniques to stay calm and focused.

- Support System: Having a support system of friends, family, and fellow traders to share experiences and advice.

Conclusion (How I Plan to Turn 22 into 1 Crore by 25 with Intraday Trading – Here’s How Much You Need to Invest!)

Turning 22 and aiming to earn 1 crore by 25 through intraday trading is a challenging but exhilarating goal. It requires a significant initial investment, a robust trading strategy, and disciplined execution. While the road ahead is fraught with risks and uncertainties, I am committed to learning, adapting, and persevering.

For those considering a similar path, remember that intraday trading is not a guaranteed way to riches. It demands extensive knowledge, emotional control, and a willingness to accept losses. Start with what you can afford to lose, and prioritize continuous learning and risk management.

As I embark on this journey, I hope to inspire and provide valuable insights to others who dare to dream big and challenge the status quo. Here’s to turning 22 into 1 crore by 25 – may the markets be ever in our favor!

My name is Rohit Vagh and I’m a content writer specializing in fashion and lifestyle. I have three years of experience in this field and have written various articles. My writing style is creative and engaging, and I strive to create content that resonates with my readers. I have a deep passion for fashion and am constantly researching the latest trends and styles to make sure my readers are up to date. I’m excited to continue my career in blogging, and I’m always looking for new opportunities in the fashion and lifestyle space.