Best UPI Payment Apps In India

- What is UPI?

UPI stands for Unified Payments Interface and it is a real-time payment system that permits you to transfer money immediately from one person’s bank account to another. Furthermore, the entire procedure can be done via a mobile application, which makes it easy when it comes to funding transfer. Also, with the help of UPI, multiple bank accounts can be managed via a single mobile application, merging numerous banking features, seamless fund routing & merchant payments into one hood.

- How UPI works?

VPA Id: One needs to share their VPA Id, then store it to begin the payment procedure. After that, you will receive a notification, and you will have to ensure the payment by arriving at the MPIN in the UPI App.

QR Code: Shops have their QR Code at the display, which requires to be scanned. Earlier, you were needed to confirm the amount by entering the MPIN in the UPI App. In the recent UPI 2.0, there is no requirement to enter the passcode. One can utilize the signed QR & intent.

Mobile Number: Money can be delivered to any mobile number, which is attached to a bank account by sharing an MMID.

Aadhaar Number: Money can be sent by sharing the Aadhar number, attached to the Bank Account. One requires to scan the fingerprints for this.

Sharing Account Number & IFSC: One of the simplest and most used methods of sending money sharing your account information, such as account number or IFSC code.

Best UPI Payment Apps List

1. Paytm

Paytm is one of the best UPI apps with loaded features for smooth transactions. It is India’s biggest digital wallet service provider, with a huge number of downloads amongst UPI apps across both Android and iOS platforms. Using this app, you can transfer money instantly from your bank. You can attach your UPI bank account with Paytm and pay at online and offline stores.

Online Shopping, Utility bills, Train Ticket Booking, Bus & Flight Booking, Movie Tickets, LIC Premium, Transactions on Paytm, you can do it all. You can even recharge your Mobile as well.

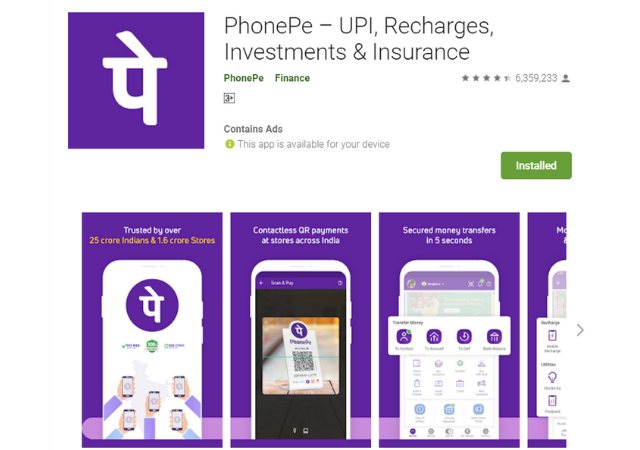

2. PhonePe

PhonePe is one of the most secure & excellent UPI apps in India. It uses the UPI Payment system for transfer money and making payments for different services. It provides you the facility of the wallet as well. You can use the app to recharge your mobile, payment for your utility bills, and online and offline store payment.

Apart from all these, you are also eligible to get an instant refund and cashback if you happen to buy or cancel an order from any of the partner merchants of PhonePe. Read more about the Best UPI Payment Apps In India.

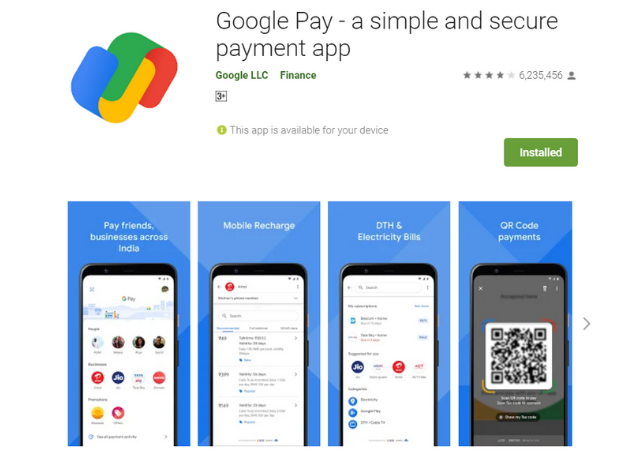

3. G Pay

G Pay, previously known as Tez App, stands as the best UPI apps in India. It is just a UPI app and does not have a wallet. But you can pay for approximately every transaction which supports UPI. You can use this UPI app to make bank transfers, mobile recharge, and utility bill payments. It ensures multiple layers of security for the protected transition. You can also browse through the recharge plans, pay the merchandisers, check your bank account balance, and book tickets using this app.

G pay also gives scratch cards for transactions. After scratching the card, users can receive a gift in the form of money which immediately gets credited into the bank account. Anyways, you won’t receive a scratch card on every transaction as there are a minimum value and number of transactions predefined by the app.

4. BHIM

BHIM App is the accepted one when it comes to the UPI payments apps in India. It was developed by the National Payments Corporation of India in a process to enhance Digital India’s strength and it is the Official Government app. So You can fully believe this app because of government monitors and control each transaction.

BHIM allows you to build a UPI ID within a few minutes. You can share this ID with people from whom you want to receive payment or use the ID to transfer money to someone using the UPI service. Apart from paying all kinds of bills, the app features a bill-splitting option too. BHIM App doesn’t offer any wallet features. So, if you pay or receive any amount, it will deduct or add directly to your bank account. Read more about the Best UPI Payment Apps In India

5. Mobikwik

Mobikwik is another popular, one of the impressive-rated UPI payment apps on the Play Store and iOS app store. It isn’t an app that is flooded with features like Paytm, but it has its own set of useful features. You can recharge your mobile, pay for utility, electricity bill, water bill, gas bill, store payment, and many more. You can also transfer money in your bank account, make a wallet-to-wallet transfer and transfer money to any bank account.

Order Medicines, Groceries, Food, Gadgets online & pay via MobiKwik. Make rapid online payments at your favorite Food Delivery, Shopping, & Travel including Pharmeasy, BigBasket, Tata CLiQ, Myntra, Ajio, Swiggy, Zomato, Flipkart, Amazon, & more. Payments can also be made for subscriptions & at entertainment sites/apps such as Netflix, Disney+Hotstar, AltBalaji, Gaana, Hungama, & more.

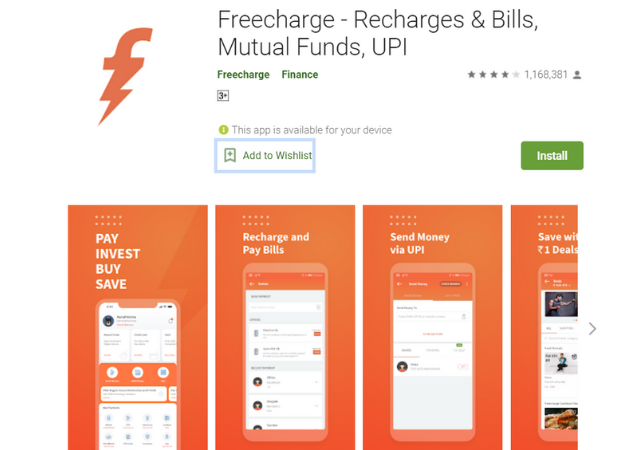

6. Freecharge

Freecharge is a Gurgaon-based fintech startup, which has now been acquired by Axis bank. For wielding this app- you require a BHIM UPI ID first. Things become simple after you link Freecharge to your bank account. Apart from the fundamental UPI features like money transactions, Store payments, bill payments, and recharges, Freecharge has some distinctive features incorporated too.

The crucial highlight of the app is its several cashback offers, in-app discounts, and other impressive offers. You can also invest in Mutual Funds, Digital Gold, Express FD. It’s a must-try app if you’re into UPI payments and online shopping and like to benefit from amazing deals.

My name is Rohit Vagh and I’m a content writer specializing in fashion and lifestyle. I have three years of experience in this field and have written various articles. My writing style is creative and engaging, and I strive to create content that resonates with my readers. I have a deep passion for fashion and am constantly researching the latest trends and styles to make sure my readers are up to date. I’m excited to continue my career in blogging, and I’m always looking for new opportunities in the fashion and lifestyle space.